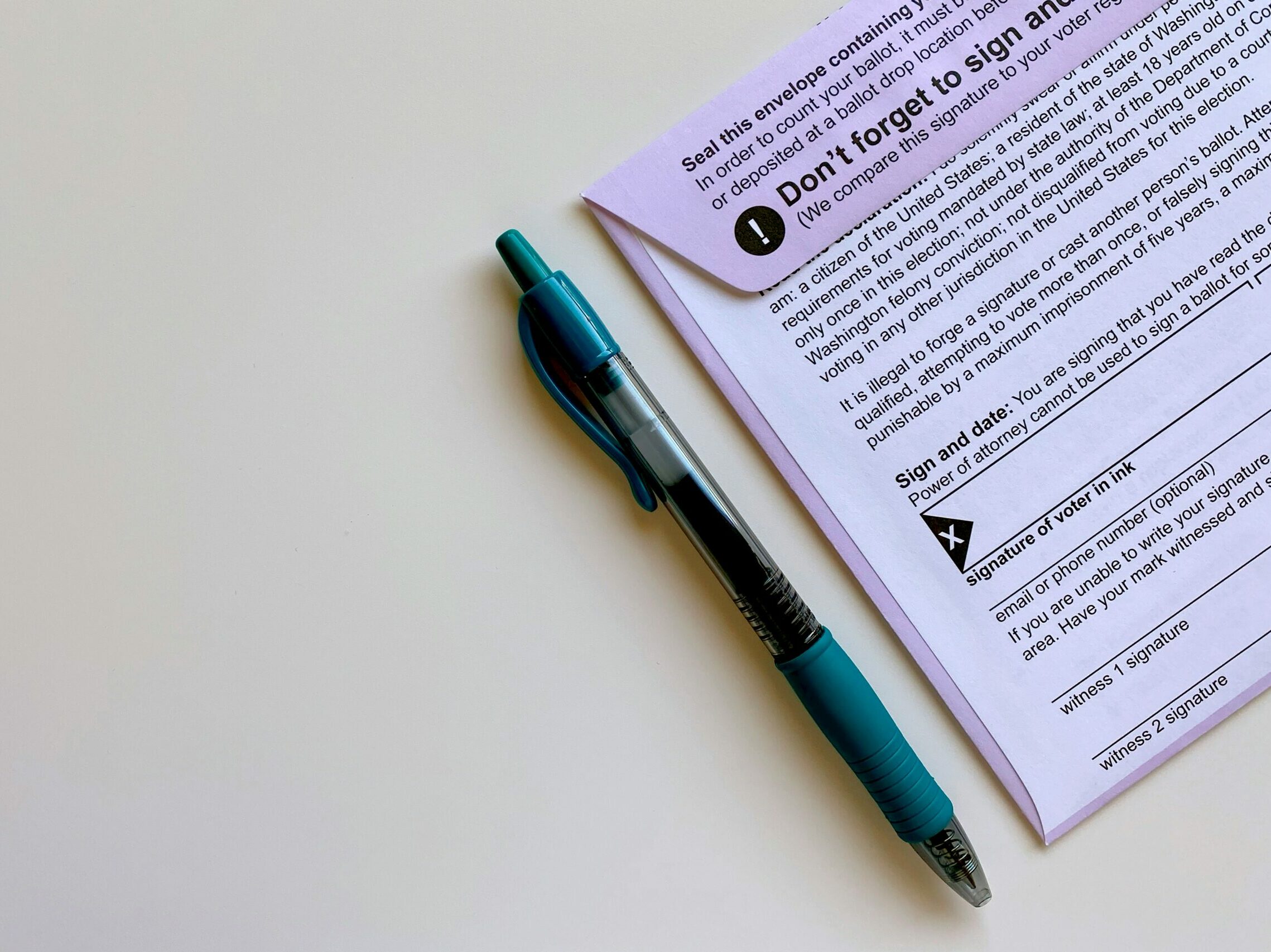

Maryland local election boards to get early start Monday on mail-in ballots

Mail-in ballots are starting to roll in across the Baltimore region as Maryland’s May 14 primary election draws near, with some jurisdictions preparing to process ballots as soon as Monday. According to the Maryland State Board of Elections, approximately 558,000 ballots have been sent to voters statewide for a primary with two presumptive presidential nominees — incumbent President Joe Biden, a Democrat, and former Republican President Donald Trump — at the top.